Marilyn fondly remembers the 1950s, when she trained and worked at the hospital as a radiology technician.

“The hospital was a significant part of my best young years,” she recalls. “I made good friends during that time, and I keep in touch with some of them even today.”

Born and raised in the Beach, Marilyn met her husband at Riverdale High School and has two children and two grandchildren. She remembers her experiences visiting the hospital when her children were young as positive ones, and always appreciated the excellent, warm care her family received.

“I enjoyed raising my family here in East Toronto, and it still has that small town feel for me,” she says. “And though I’m fortunate to be in great health, and plan to live for a long time, knowing there is this wonderful local hospital in our community is comforting.”

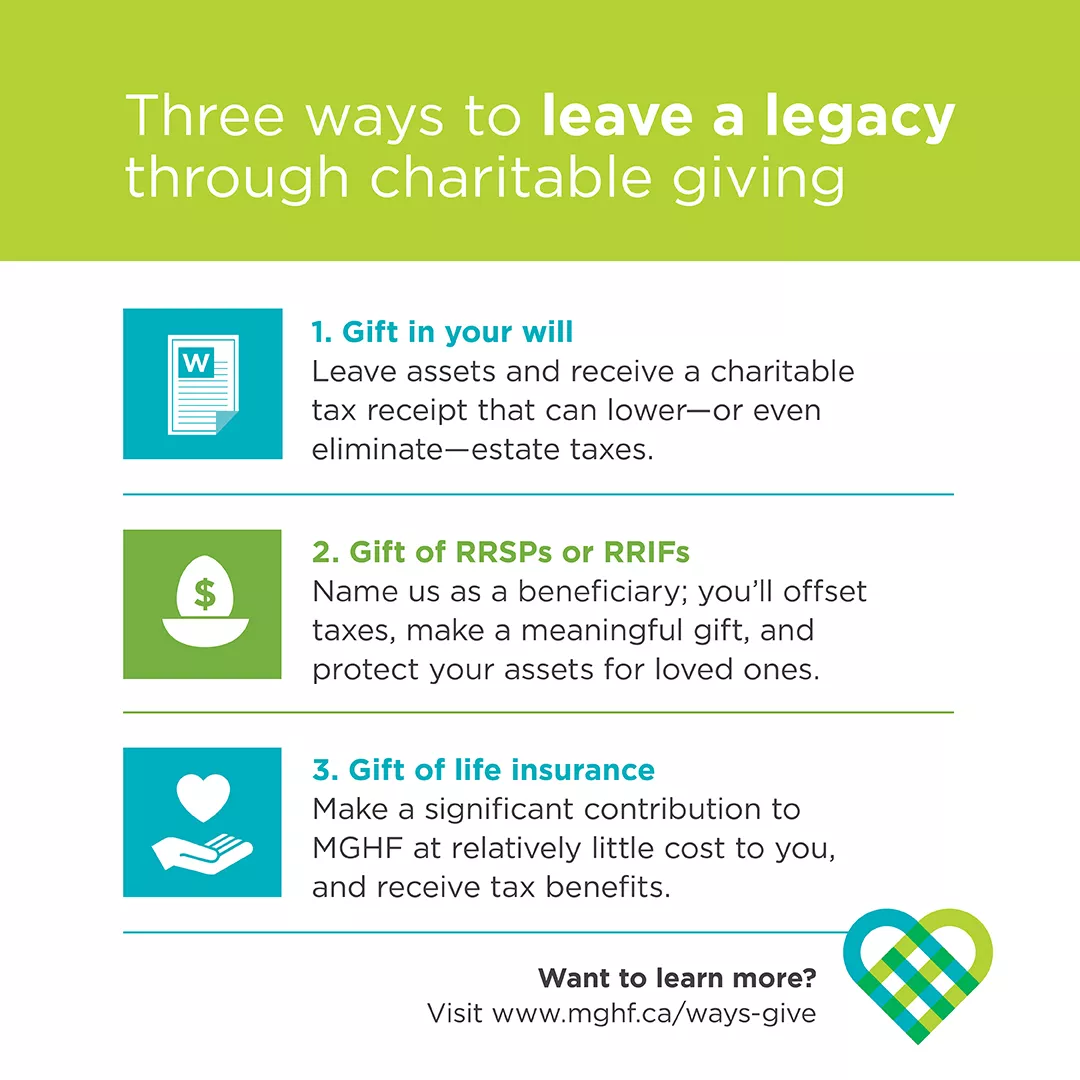

Benefits of giving in a will

Marilyn is honest about the motivation behind her decision to leave a gift in her will to Michael Garron Hospital.

Her husband Robert died more than 30 years ago, leaving her widowed while she was still quite young. Several years ago, she sat down with her financial planner and her lawyer to discuss her finances. She was shocked to discover how much tax her estate would have to pay after her death, on the appreciated assets she had inherited.

Marilyn and her advisor considered different ways to structure her will in combination with charitable giving to avoid paying capital gains tax.

“While it’s important to me that we pay taxes for the common good of society, it also makes sense that I can divert some of that government tax to an organization that is close to my heart,” she says.

It was important for Marilyn to make sure that her children were in agreement with any financial decisions she made about her estate.

“After discussing it with my children, they agreed that donating these assets to the hospital—a place which holds many happy memories for all of us—was the right decision,” says Marilyn.

A gift of securities in her will also provides Marilyn’s estate with a charitable tax receipt that could lower—or even eliminate—estate taxes.

A family legacy

Her commitment to leaving a gift in her will allows Marilyn to honour her entire family, including her late husband.

As a member of the Joseph H. Harris Society—an honorary society of individuals who have pledged to leave a planned gift to Michael Garron Hospital—Marilyn’s gift is recognized as The Robert Francis Family.

“I live on a limited income now, and I’m not able to give back to the extent that I’d like,” says Marilyn. “Giving a gift in my will is not only tax-advantageous; it’s also an opportunity for me to make a larger impact later on. Every one of us will eventually need our community hospital; I feel good about being able to give back in this way.”

Learn more about ways to give, or contact Yolanda Bronstein at 416-469-6003 x2161, or Yolanda.Bronstein@tehn.ca